Purpose

Money is an ingenious invention. For a bank it is the linchpin of action. At GLS Bank, we understand money as a means of shaping society. In times of short selling and money creation, detached from the real economy, it is even more important to get money directly to entrepreneurs and projects. The purpose of our daily work is to use this instrument in such a way that it benefits people and preserves our livelihood. We work every day to create a sustainable future worth living in. In addition to ecological considerations, we also pay attention to social aspects. That is why we also finance nursing homes, organic agriculture, or cultural projects.

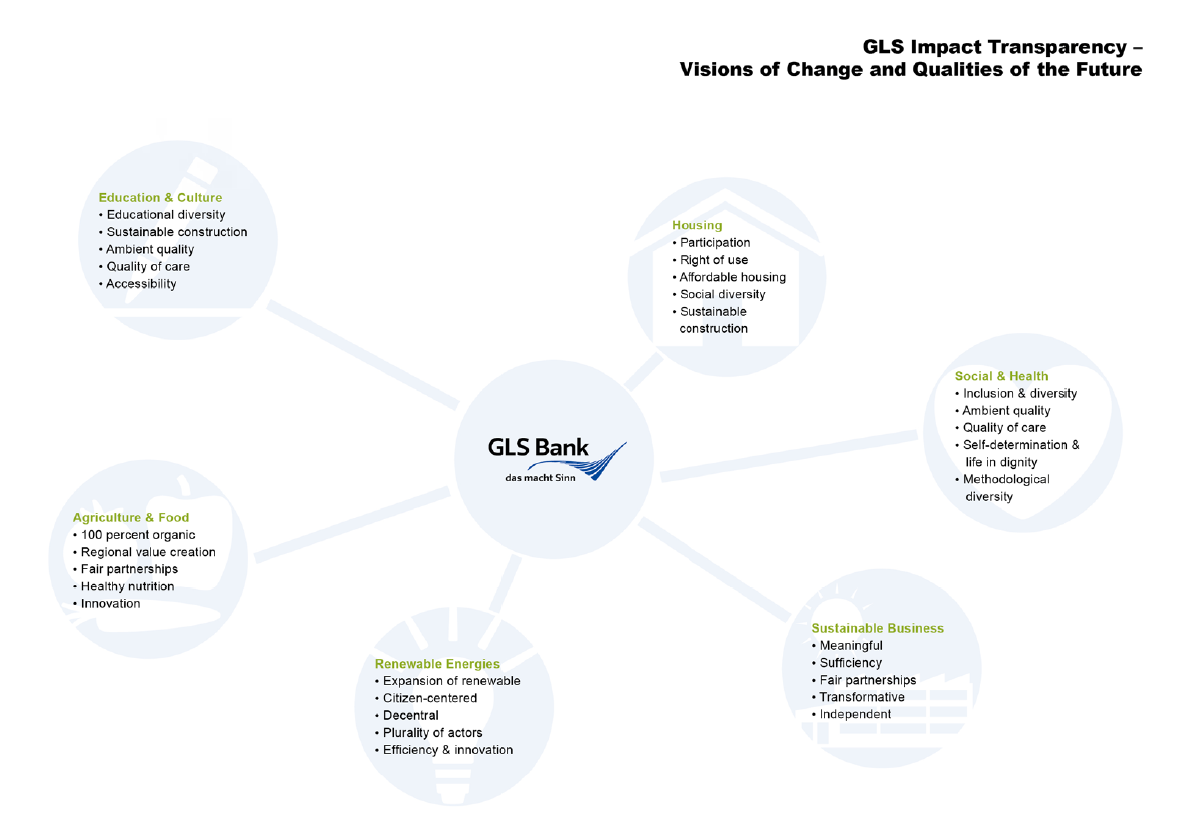

Our visions of the future show what the meaningful and effective use of money can look like in practice. They define which future we as GLS community consider desirable. We mapped out a vision of the future for each of our six sectors. Drawing on numerous indicators, we measure the impact on the future state defined as ideal in each case - the vision of the future. At the same time, these visions give our work as a bank a deeper meaning and make our aspirations towards shaping society transparent and measurable.

Mission statement of GLS Bank

The foundations for the work of GLS bank are respect for the diversity of life and nature and concern for the peaceful coexistence of all cultures based on individual freedom and responsibility. We take people seriously in their totality of body, soul and spirit.

Our actions should preserve the natural foundations of life for present and future generations and promote their further development. We understand ecology holistically as the unity of nature and the development of civilisation. We address people who pursue ecological, social, or cultural goals and want to help shape our society creatively. Together, we develop new forms of banking that are determined by solidarity and responsibility for our environment.

We use money as a means of shaping society which allows us to combine professional financial services with the questions and issues of our times. Through a conscious, use-oriented approach to money management, we promote and shape sustainable social development with our customers and make clear the different qualities of money in buying, lending, and giving.

What responsibility do banks have?

Due to the immense volume of money that banks manage and move each year, they have an outstanding steering effect and influence the economy. With the standards that banks apply to make financing decisions, they influence the management of companies looking for financing.

At the same time, banks can most easily pass on their costumers’ deposits as loans. Thus, customers have the power to decide about their own money and social investments by choosing a bank. Before opening an account, they can ask themselves: Does this bank lend to companies that invest in armaments, gambling, or coal energy? Or does that bank lend to sustainable and future-oriented companies that create positive meaning? In short, does the bank finance war or the basis for peaceful and just coexistence?

If the bank’s benchmarks include ambitious climate protection targets, socio-ecological sustainability criteria or a focus on the common good, an incentive is created for these criteria to be met or given greater consideration in the company. Through this influence, banks can make a considerable contribution to climate protection, greater equity, and a profound transformation of the economy.

For example: If all banks would also consider the impact of the financed enterprises on the climate, there would be no coal-fired power plants. These would simply not be financed by any bank – or the loan conditions would be so high due to the climate risks that they would also be unattractive to the borrower. If, however, banks focus primarily on yield and growth when granting loans, companies will be guided precisely by these indicators.

This is GLS Bank

Since its foundation in 1974, GLS Bank has been collaborative, sustainable, and transparent. Sustainability in not a buzzword with us. It is part of our DNA. Our entire lending and investment business, all actions, decisions, and operational processes are consistently aligned with our principles of sustainability.

The bank with green DNA

Since 1974, GLS Bank - Gemeinschaft für Leihen und Schenken - which translates to “community for lending and giving”, has been Germany’s first socio-ecological bank. We finance sustainable enterprises instead of speculating on financial markets.

We are a cooperative bank because we love to do things together. We are part of a large network: Together with companies, organisations, alliances, and activists, we work on a future worth living.

Our forward-looking banking work benefits people and the environment. Our economic profit is the consequence of our actions and not the end. With our business model, we have been leading the way for others – since our founding more than 45 years ago. We show companies and banks how to not only integrate sustainability into their business, but how sustainability becomes a corporate purpose, a sail, and a compass.

In addition to our core business as a bank, it is important to us to create awareness for an impactful use of money. And we get involved: We call for political framework conditions to pave the way for a socially and ecologically compatible economy. Our political demands can be found in the chapter “Scalability“.

We are uniquely transparent! We disclose every single company financing as well as our own investments. Additionally, our customers can express their wish as to which of our selected sectors their money should be invested in.

We accompany our corporate clients on their way to a thoroughly sustainable economy and make their socio-ecological impact measurable and transparent.

GRI references: GRI 102-1, GRI 102-2, GRI 102-3, GRI 102-4, GRI 102-5, GRI 102-6, GRI 102-16, GRI 102-17, GRI FS12, GRI FS13, GRI FS14

Sustainable offers

We offer everything expected from a modern bank: checking and money market accounts, financing, funds, investments, provision, and more. We also offer the opportunity to make a gift and to participate via the Crowd. Everything is 100 percent sustainable. We invest money where it has a positive impact: in meaningful companies and projects.

Our customers can be sure that strict social and ecological criteria, our so-called investment and financing principles, are implemented throughout our entire range of products and services. For example, we exclude companies that are associated with nuclear power, weapons, child labour or genetic engineering. Instead, we invest exclusively in forward-looking business areas, for example in renewable energies, the organic sector, affordable housing, and environmentally friendly mobility. Our investment committee regularly examines whether securities in which we are invested meet our criteria. Our investment and financing principles also apply to our own investments. Each loan advisor is an expert in the respective sector and thoroughly examines whether a project meets the values and criteria of GLS Bank.

The GLS group

Photo: Steinmeyer

GLS BAG

The GLS Beteiligungs AG, GLS BAG for short, aims to help shape social transformation by making projects from the renewable energy, organic food and nutrition and sustainable economy sectors investable and accompanying them throughout their life cycle. It is a subsidiary of GLS Bank and is internationally oriented.

GLS Investments

The GLS Investment Management Ltd, GLS Investments for short, is a wholly owned subsidiary of GLS Bank. The employees take care of the management of socio-ecological investment funds. GLS Investments is one of the most rigorous players in the market and is responsible for the GLS investment universe. The selected products are the result of our own socio-ecological research, an investment committee and our own economic analyses. The expertise feeds into the management of the four existing investment funds. GLS Investments is based in Bochum and operates worldwide.

GLS Trust

GLS Trust has been developing a culture of giving for more than 50 years. It supports people in using their money in the best possible way for civic engagement and social entrepreneurship through donations, foundations, and wills. In doing so, GLS Treuhand stands for a culture of giving that combines individual freedom with social action.

GLS Future Foundation for Development

The GLS Future Foundation for Development works together with project partners to identify the causes of poverty, hunger and need. The focus is on understanding and fathoming the connections between nature and the economy.

GLS Crowd

In addition to the subsidiaries, there is also a cooperation with the online platform GLS Crowd. It connects people who want to help realise socio-ecological projects with their money with entrepreneurs and their forward-looking ideas. Portagon GmbH, a Frankfurt-based FinTech, operates the Crowd platform, while GLS Bank proposes suitable crowd investing projects for placement. In this way, over 34 projects have already been financed with the power of the crowd.

GLS Mobilität

With GLS Mobilität as part of the GLS community, we are making our contribution to a sustainable transformation of mobility. In our vision of the future, we see ourselves as initiators and enablers of forward-looking mobility solutions. These are characterised by connectivity, participation, accessibility, frugality and multi-modality.

GLS Immowert

Investment decisions in real-estate have long-term relevance. GLS Immowert consists of experienced experts for well-founded market and reliable building assessments. As a neutral, objective authority, we have been a multi-functional partner for our costumers for 20 years: in the valuation, consulting and support of the acquisition and sale of real estate from a single provider.

Review

Our Year 2021

Money & People

-

9.2 billion €

total assets (+15%)

-

321.000

customers (+15%)

-

7.7 billion %

account deposits (+16%)

-

104.000

members (+25%)

-

4.4 billion €

customer loans (+5%)

-

820

employees (+17%)

-

707 million €

net equity (+12%)

Locations

Sectors: This is what the GLS Bank finances

-

30%

Renewable Energies

Investments for energy generation from wind, sun, biomass (wood), and biogas (exclusively farmsteads in organic farming)

-

11%

Education & Culture

Schools and kindergardens, vocational and adult education, culture

-

7%

Food and nutrition

Organic food, ecological farming

-

28%

Housing

Housing projects, residential properties and private construction financing

-

16%

Social matters & Health

Life in old age, institutions for handicapped, health, child and youth welfare

-

9%

Sustainable economy

Socio-ecologial products and services

Our exclusion criteria

-

... for

nuclear power, coal power, factory farming and non-organic farming, armament and weaponry, biocides and pesticides, genetic engineering in agriculture, embryo research, addictive drugs, organochlorine mass products

Paris Climate Agreement & Gender Pay Gap

-

1.5°C

compatibility of operational processes of the GLS Bank

-

1.5°C

compatibility of our loan portfolio

-

12%

Gender-Pay-Gap (-1.7%-points)

Sustainability Management and Goals

Sustainability has been an integral part of all decisions, actions, processes, and brand core values of GLS Bank since its foundation.

How does sustainability work without sustainability management?

The bank is growing. In 2020 alone, 38.000 new customers joined us, and our balance sheet total rose to more than 1.3 billion Euros – an increase of more than 15 percent over the previous year. Furthermore, we welcomed 103 new employees to GLS bank. Therefore, we need internal processes and structures that ensure a mutual understanding of and adherence to shared values. At the same time, major organisations and rating agencies, such as the Fair Finance Guide or the United Nations Principles for Responsible Investment as well as a more vigilant society, are increasingly asking for established standards and processes regarding sustainability. In addition, there are national and international regulatory requirements and laws such as the CSR Directive Implementation Act, the German Climate Protection Act, the EU action plan, the SDGs and the BaFin (the German Federal Financial Supervisory Authority) bulletin. Corporations and also many banks increasingly have to deal with sustainability issues.

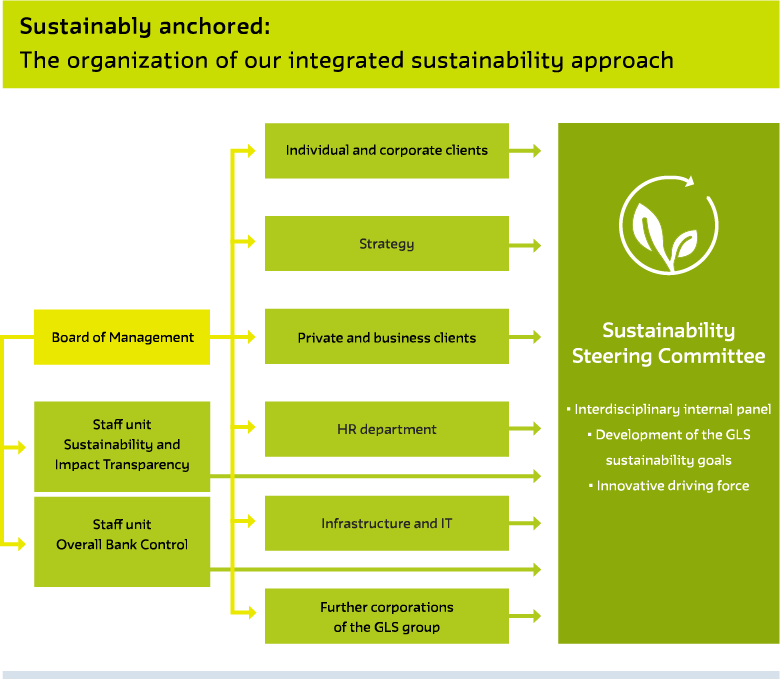

As the first socio-ecological bank we want to live up to our role. We want to set the benchmark for sustainable banking and be a beacon for others. To this end, we established the Impact Transparency and Sustainability unit in 2018. In the meantime, more than 20 team members are continuously developing the bank-wide sustainability management, working out strategic and operational sustainability targets. The team is introducing innovative approaches to measuring the climate impact of banks as well as the social impact of the GLS community.

Which topics we focus on is determined by our materiality analysis. We use it to inquire from different stakeholders which sustainability topics they consider relevant for the GLS Bank. Next to the staff unit for sustainability, there is a sustainability control committee, composed from members from almost all departments. This committee is many things: thinktank, innovation laboratory, advisory unit, and implementation group. Most of all it takes care of the development of the sustainability goals and their implementation into tangible measures.

Sustainability management

Sustainability can be more than a value-based orientation. It can be compass, sail, and wind at the same time. At GLS Bank, sustainability is anchored everywhere – in our strategy, our structure, our actions, and our goals.

Our strategy for a sustainable future

We have decided against a separate sustainability strategy. This is because sustainability permeates everything we do. That is why our corporate strategy integrates our sustainability, risk, and business strategy.

Excerpt from our integrated sustainability, business, and risk strategy, which we simply call corporate strategy:

The starting point for our corporate strategy is our mission statement. The United Nations Sustainable Development Goals (SDGs) were intended to provide a basis for shaping global economic progress in harmony with social justice and within the Earth’s ecological limits. In this way they currently form an accepted global framework of thematic priorities in the field of sustainability. They also serve as an orientation for GLS Bank. Within this framework and beyond, we prioritise the sustainability issues that are essential for GLS Bank.

Added to this are the results of the regular materiality analysis. The identified sustainability issues form the starting point for our financial and non-financial goals. These are closely interlinked (=integrated goals) and in some cases merge into one another, since there is a socio-ecological purpose behind every financial target and economic profit alone is never the goal of our actions.

In light of the urgency of the climate crisis, all our business activities are conducted against the backdrop of containing global warming to a maximum of 1.5°C. We pursue this 1.5°C compatibility for our internal processes as well as our investment and loan portfolio.

GRI references: GRI 102-9, GRI 102-10, GRI 102-11, GRI 102-12, GRI 102-14, GRI 102-15, GRI 102-21, GRI 102-26, GRI 102-29, GRI 102-31, GRI 102-40, GRI 102-42, GRI 102-43, GRI 102-44, GRI 102-46, GRI 102-47, GRI 103-1, GRI 103-2, GRI 103-3

Our Visions of Change

Banks can decide where their money flows to and what it is being used for. As the GLS community, we set forward-looking standards for responsible economic activity and for the societal transformation towards an economy that operates within the planetary boundaries. With this end in view, our Impact Transparency developed co-called Visions of Change, that define our aspirations to shaping society and ascribe them with measurable impact indicators.

Our goal is using money as a societal means of design and put it to use where it makes sense. Our Visions of Change show where that purpose lies. They define which traits and qualities we view as indispensable for a sustainable development in the sectors we are active in. The central question for this development is: “What kind of world do we want to live in?”. With our Visions of Change, we define this idea of a socio-ecological world. They accompany us in our daily bank business and are the anchoring point for our societal impact. With our Impact Transparency we give our decisions an even deeper purpose.